On Friday evening, Elon Musk, richest man in the world, the guy who very badly wanted to buy Twitter before deciding he was over it, went ahead and scotched the $44 billion deal. Or at the very least, he’s trying to. Just before 5:30 p.m., his lawyers filed a letter with the Securities and Exchange Commission calling Twitter’s data on spam bots “false and misleading” and saying Musk blames Twitter’s board for not providing him with the information necessary to understand the number of bots on the platform — a particular bugbear for him — and for throttling his ability to even look at the data provided.

To recap: Soon after Musk agreed to buy Twitter at $54.20 a share (about 30 percent higher than where it’s trading today), he appeared to have had a case of buyer’s remorse. Musk has since focused on a particular metric the company uses to measure spam bots: the number of monetizable daily active users, which it abbreviates as mDAU. Twitter maintains that under 5 percent of those users are spam bots, but it’s a proprietary metric, and anyone who uses the platform can see with their very eyes that bots are an annoying problem. Still, even though the metric is functionally meaningless to an outside observer, it’s the number that goes into the ad machine, which is by far the biggest driver of Twitter’s revenue. Musk has argued that Twitter isn’t being forthright about how spammy it is and, therefore, isn’t being transparent about its advertising business; he begged the board for more data about it until it relented last month by giving him, quite literally, every tweet.

But Musk still wanted more. In particular, he wanted the company’s internal metrics, materials for board members, and the formula for measuring the mDAUs, as his lawyers wrote in today’s letter. Apparently, the Twitter board gave Musk a data set that capped how many queries he would be able to make into it and had more restrictions on how the data could be parsed than comparable customer information. (After Musk complained, Twitter apparently fixed the problem.) This is pretty wild since Musk has been obviously trying to get out of the deal and has used Twitter’s unresponsiveness to his requests as a legal cudgel before.

Now, Musk is coming out hard against Twitter based on the analysis he was able to do, and he essentially called the board members liars about the number of fake accounts pervading the platform. “While this analysis remains ongoing, all indications suggest that several of Twitter’s public disclosures regarding its mDAUs are either false or materially misleading,” according to Mike Ringler, Musks’s lawyer at Skadden, Arps, Slate, Meagher & Flom. Specifically, Musk and his team believe that the number of spam bots in the mDAU calculation is “wildly higher” than 5 percent and — this could be the most damning revelation — that Twitter knowingly includes suspended accounts among those users. For its part, the company says it will see Musk in court. “The Twitter Board is committed to closing the transaction on the price and terms agreed upon with Mr. Musk and plans to pursue legal action to enforce the merger agreement. We are confident we will prevail in the Delaware Court of Chancery,” chairman Bret Taylor tweeted in response.

So can Musk get out of it? I guess it depends on what he wants. Musk’s team is alleging a material breach of the merger agreement — that Twitter lied about the bots, so that breaks the deal, and he shouldn’t be held to an alleged bait and switch. (He also says that he didn’t forgo his right to perform due diligence and that he negotiated his right to do it after the merger agreement, which is weird.) For good measure, Ringler throws in a couple more accusations at the end of the letter about losing key people from the workforce and doing a round of layoffs, all without Musk’s consent, but Twitter can’t force people to work there, and layoffs are now rampant in tech, so that feels a little like spaghetti thrown at a wall.

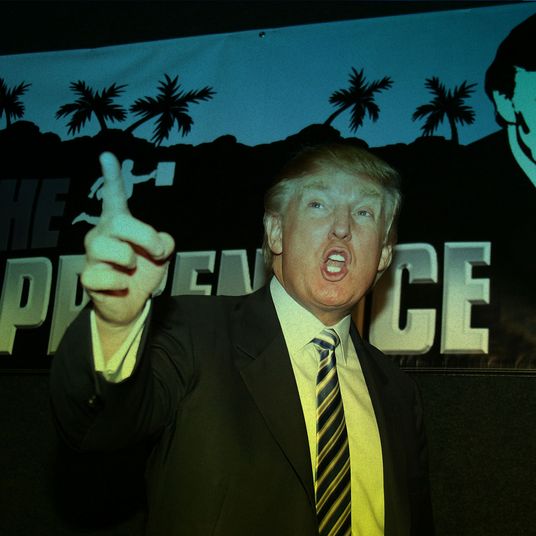

It looks unlikely that the Twitter board will just let Musk walk away and pretend none of this ever happened; it’s in their interest to get a lot more money for the company than what it’s presently worth. Instead, the board seems intent to go to court, where Musk would have to convince a judge to let him out of the merger agreement he signed. Another possibility is that each side could negotiate terms down in order for both to save face and claim a victory. Whatever happens, it’s probably going to further delay Donald Trump’s ignominious return to the platform, so that will perhaps limit a different kind of spam, at least for now.